Below is the text of an alert that we sent to our clients. We are re-posting on our blog.

Dear Clients and Friends,

On March 13th, we provided advice about preserving commercial lease obligations through COVID-19: https://www.coopersmithandcoopersmith.com/2020/03/13/preserving-your-commercial-lease-through-covid-19/

On March 23rd, we wrote about the current state of rent and mortgage payments: https://www.coopersmithandcoopersmith.com/2020/03/23/making-sense-of-rent-and-mortgage-obligations-amid-confusing-times/

The purpose of this email is to provide guidance on the “Coronavirus Aid, Relief, and Economic Security Act” or “CARES Act” passed on Friday and the programs available to businesses (commercial tenants), and owners of single family and multifamily residential real estate.

Should you have any questions about your own circumstances, please feel free to respond to this email.

Paycheck Protection Program

Regulations from the

Small Business Administration (SBA) will be created no less than 15 days,

but here’s what we know now:

Eligibility:

- Businesses with up to 500 employees (includes employees on a full time and part time basis)

- Self-employed individuals, provided they earn less than $100,000.00 annually

Maximum loan amount:

The lesser of Ten

Million ($10,000,000.00) Dollars; and the sum of 2.5 times the average total

monthly payroll costs for the prior year. Salaries in excess of

$100,000.00 are excluded from this calculation

Permitted uses for the loan:

- Salaries and payroll costs

- Healthcare benefits

- Rent

- Utilities

- Interest debt incurred before February 15, 2020 (but not any payments or prepayments of principal)

Material terms for a loan:

- Interest rate will not exceed 4%

- There will be no fee for applying for the loan

- No personal guaranty will be required

- No collateral will be required

- No prepayment penalty will be incurred

- Initial payments will be DEFERRED at least six (6) months but not more than twelve (12) months

Applicant must certify that:

- Uncertainty of current economic conditions makes the loan request necessary

- Funds will be used to retain workers or make mortgage payments, lease payments and utility payments

- There is not a duplicate application/ applicant has not received a loan for the same purpose

- They have not received a loan for the same purpose

How to turn a portion of the loan into a grant, i.e. loan

forgiveness:

For the eight (8) week

period after loan origination:

Funds used for salaries and payroll costs, healthcare benefits, rent, utilities, and interest debt incurred before February 15, 2020, will be forgiven, however if the business has fewer employees (earning less than $100,000.00) before the COVID-19 emergency the forgiven amount will be reduced using the following formula:

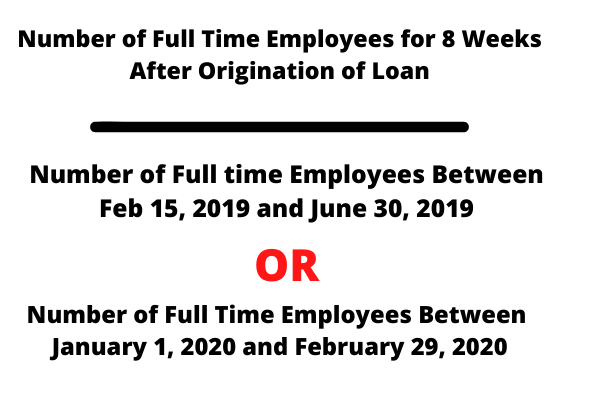

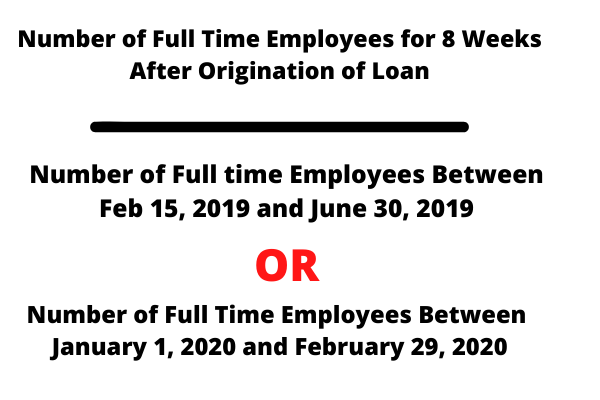

Number of Full Time Employees for 8 Weeks After Origination of Loan

DIVIDED BY:

Number of Full time

Employees Between Feb 15, 2019 and June 30, 2019

OR

Number of Full Time Employees Between January 1, 2020 and February 29, 2020.

Please refer the graphic below for further illustration.

Exemption for rehiring workers

If a business rehires employees and eliminates the reduction of salaries/wages before June 30, 2020 the business will be eligible for loan forgiveness. Note: this part of the law is vague. Expect regulations to be issued clarifying this provision.

Required documentation will include:

- Payroll tax filings to the IRS

- State income, payroll, and employment filings

- Cancelled checks, payment receipts, and transcripts of accounts

Single Family Residential Real Estate

- Owners of single family residential real estate with a federally backed mortgage are allowed forbearance for up to one hundred eighty (180) days, which may be shortened at request of borrower

- Borrower may also request forbearance for an additional one hundred eighty (180) day period

- No additional documentation is required from borrower other than an affirmation

- No fees, penalties, or interest will accrue during forbearance period

- Additional notes:

- Forbearance means that borrower still owes the money, just at a later date

- Federally backed loans have a limit on the amount borrowed. For example, in 2020 the maximum amount for a one family unit in New York City was $765,000.00 https://www.housingwire.com/wp-content/uploads/2019/12/2020areasatceiling.pdf

- Check with your lender to see if your loan is federally backed

Multifamily Residential Real Estate

Note: the below applies only to owners of multifamily residential real estate with federally backed mortgages

- Owners are allowed forbearance on their mortgage for up to thirty (30) days

- Owners may request two (2) additional thirty (30) day forbearance periods provided such request is made at least fifteen (15) days prior to the expiration of any forbearance period.

- Owners have the right to discontinue forbearance at any time

For one hundred twenty (120) days from Implementation of CARES ACT, Owners:

- Cannot initiate an eviction proceeding for the non-payment of rent

- Cannot charge any late fees, penalties or interest for non-payment of rent (Note: in New York State the limit for any late fee is $50 per month)